The Application of Logistic Regression to Measure the Impact of Covid-19 Pandemic on Household Credit Financing

Main Article Content

Abstract

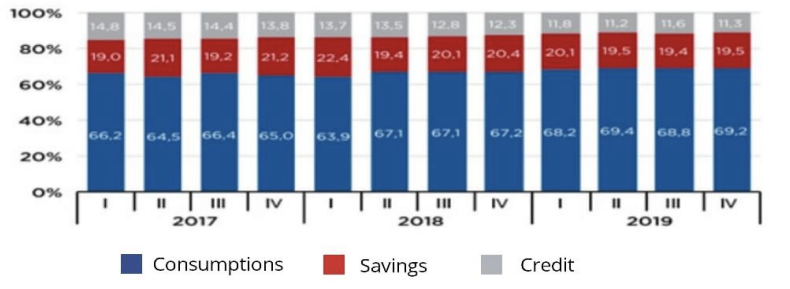

The spread of the Covid-19 outbreak has a direct impact on the economic sector. The impact of Covid-19 on the economic sector can be seen from Non-Performing Loans (NPL). Credit financing affects the Financial System Stability. Furthermore, households are the sector most affected by Covid-19, because household income is obtained from other sectors that are also affected by the spread of Covid-19. This impact can be seen in terms of income, savings/assets, and consumption. This study aims to analyze the impact of Covid-19 as measured by the variables of income, savings/assets, and consumption on household credit financing using the Logistic Regression Model. The modelling results show that the consumption and savings variables do not have a significant effect on household credit financing, while the income variables have a significant effect and are able to predict 15.5% of the variability of household credit financing. Furthermore, based on the odds ratio value of the model, information is obtained that the effect of decreased household income during the Covid-19 pandemic affected one time on the value of the odds ratio for household credit financing. Overall, the model was able to predict the data correctly by 81.4%.

Article Details

Section

How to Cite

References

L.-L. &. S. K.-R. Yen-Chin, "COVID-19: The First Documented Coronavirus Pandemic In History," Biomedical Journal, xxx(xxx), 1-6, p. https://doi.org/10.1016/j.bj.2020.04.007, 2020.

N. Zhu, " A Novel Coronavirus from Patients with Pneumonia in China, 2019," The New England Journal of Medicine, no. DOI: 10.1056/NEJMoa2001017, pp. 382, 727-733 , 2020.

C. Huang, "Clinical Features Of Patients Infected With 2019 Novel Coronavirus In Wuhan, China," The Lancet, 395(10223) , no. https://doi.org/10.1016/S0140-6736(20)30183-5, pp. 497-506 , 2020.

Z. &. M. J. M. Wu, "Characteristics of and important lessons from the corona virus disease 2019 (COVID-19) outbreak in China: summary of a report of 72 314 casesfrom the Chinese Center for Disease Control and Prevention," JAMA, pp. 13(323), 1239-12, 2020.

A. I. G. I. M. G. A. &. E. S. Cortegiani, "A SYSTEMATIC REVIEW ON THE EFFICACY AND SAFETY OF CHLOROQUINEFOR THE TREATMENT OF COVID-19," Journal of Critical Care , vol. 57, no. https://doi.org/10.1016/j.jcrc.2020.03.005, pp. 279-283, 2020.

F. R. &. P. A. Susilawati, "Impact of COVID-19’s Pandemic on the Economy of Indonesia," Budapest International Research and Critics Institute-Journal (BIRCI-Journal), vol. 3(2), pp. 1147-1156., 2020.

W. &. F. R. McKibbin, The Economic Impact Of Covid-19, London: CEPR Press, 2020, pp. 45-51.

M. A. Z. S. C. K. A. A.-J. A. I. C. e. a. Nicolaa, "The Socio-Economic Implications Of The Coronavirus Pandemic (Covid-19)," International Journal of Surgery , vol. 78 , no. https://doi.org/10.1016/j.ijsu.2020.04.018, pp. 185-193, 2020.

M. Fauzia, "Kredit Macet Perbankan Naik Tipis Februari 2020 Dampak Corona," Kompas.com, 2020.

H. Kusuma, "Kredit Macet Naik Dampak Corona Mulai Terasa," detikFinance, 2020.

M. Wareza, "Ini 4 Sektor yang Bikin Kredit Macet Bank RI Naik," CNBC Indonesia, 2020.

D. A. Salsabila, "Dampak Pandemi Covid-19 terhadap Nasib Perbankan dan Bank Perkreditan," Suara.com, 2020.

CNN, "Melihat Basa-Basi Relaksasi Pembayaran Kredit Saat Corona," CNN Indonesia, 2020.

Tempo, "Pandemi Corona Bagaimana Dampaknya ke Industri Perbankan," Tempo.co, 2020.

B. Indonesia, "Kajian Stabilitas Keuangan," Bank Indonesia, Jakarta, 2016.

A. A. &. A. L. Dienillah, "Dampak Inklusi Keuangan Terhadap Stabilitas Sistem Keuangan Di Asia," Buletin Ekonomi Moneter dan Perbankan, vol. 18(4) , pp. 409-430, 2016.

D. Putra, "Menjaga stabilitas sistem keuangan di tengah pandemi covid-19," infobanknews.com, 2020.

M. D. S. W. &. A. A. Hadad, "MODEL DAN ESTIMASI PERMINTAAN DAN PENAWARAN KREDIT KONSUMSI RUMAH TANGGA DI INDONESIA," BI Research Paper, vol. 6(1), pp. 1-25, 2004.

L. &. B. I. B. 2. Mukarromah, "Pengaruh Pertumbuhan Tabungan, Deposito, Dan Kredit Terhadap Pertumbuhan Profitabilitas PT. BPR Partakencana Tohpati Denpasar," E-Jurnal Manajemen Unud, vol. 4(8), pp. 2286-2300, 2015.

Tempo, "LPS masyarakat makin rajin menabung selama pandemi corona," Tempo.co, 2020.

K. D. Amajihono, "Penundaan Pembayaranangsuran Kredit Dampak Covid-2019 Di Indonesia," Jurnal Education and development, vol. 8(3), pp. 144-155, 2020.

A. K. (. Pakpahan, "COVID-19 dan Implikasi Bagi Usaha Mikro, Kecil, dan Menengah," Jurnal Ilmiah Hubungan Internasional , vol. 16(1), pp. 59-64, 2020.

J. W. Goodell, " Covid-19 and Finance," Finance Research Letters, vol. 35, no. https://doi.org/10.1016/j.frl.2020.101512, pp. 1-5, 2020.

T. &. L. P. L. Lagoarde-Segot, "Pandemics Of The Poor And Banking Stability," Journal of Banking & Finance, vol. 37(11), pp. 4574-4583, 2013.

E. Skoufias, "Economic Crises and Natural Disasters: Coping Strategies and Policy Implications," World Development, vol. 31(7), pp. 1087-1102, 2003.

E. Olaniyi, "Socio-Economic Impacts Of Novel Coronavirus: The Policy Solutions," BizEcons Quarterly, Strides Educational Foundation, vol. 7, pp. 3-12, 2020.

A. Indraini, " Duh nyaris 2 juta pekerja dirumahkandan kenaphk gegara corona," detikFinance, 2020.

H. K. A. S. M. M. &. N. S. HS, "Konsep Kebijakan Strategis Dalam Menangani Eksternalitas Ekonomi Dari Covid-19 Pada Masyarakat Rentan Di Indonesia," Indonesian Journal of Social Sciences and Humanities, vol. 1(2), pp. 130-139, 2020.

W. Hadiwardoyo, "Kerugian Ekonomi Nasional Akibat Pandemi Covid-19," BASKARA, vol. 2(2), pp. 83-92, 2020.

W. Bank, " Coronavirus Covid19," worldbank.org, 2020.

A. P. B. T. &. A. K. Iskandar, "Peran Ekonomi dan Keuangan Sosial Islam Saat Pandemi Covid-19," SALAM; Jurnal Sosial & Budaya Syar-i, vol. 7(7), pp. 625-638, 2020.

A. F. Thaha, "Dampak Covid-19 Terhadap UMKM Di Indonesia," JURNAL BRAND, vol. 2(1), pp. 147-153, 2020.

M. &. A. R. H. Ubaidillah, "Tinjauan Atas Implementasi Perpanjangan Masa Angsuran Untuk Pembiayaan Di Bank Syariah Pada Situasi Pandemi Covid-19," ISLAMIC BANKING: Jurnal Pemikiran dan Pengembangan Perbankan Syariah, vol. 6(1), pp. 1-16, 2020.

P. Warjiyo, "Stabilitas Sistem Perbankan Dan Kebijakan Moneter: Keterkaitan Dan Perkembangannya Di Indonesia," Buletin Ekonomi Moneter dan Perbankan, pp. 429-454, 2006.

Sugiyono, Metode Penelitian Kuantitatif, Kualitatif dan R&D, Bandung: Alfabeta, 2011.

R. D., Ekonometrika dan Analisis Runtun Waktu Terapan dengan Eviews, Yogyakarta: Penerbit Andi, 2011.

M. Scott, Logistic Regression: From Introductory to Advanced Concepts and Applications., Los Angeles: Sage, 2010.

J. M. Hilbe, Logistic Regression Model, Florida: CRC Press, 2009.

S. M. Frank J. Fabozzi, The Basics of Financial Econometrics: Tools, Concepts, and Asset Management Applications, New Jersey: John Wiley & Sons, Inc., 2014.