Quick Menu

Citation in Scopus

Contact Editor-in-Chief

Article Template

Tools

Visitors

Statistics

Source: Scopus.com

Last update: April 15, 2025

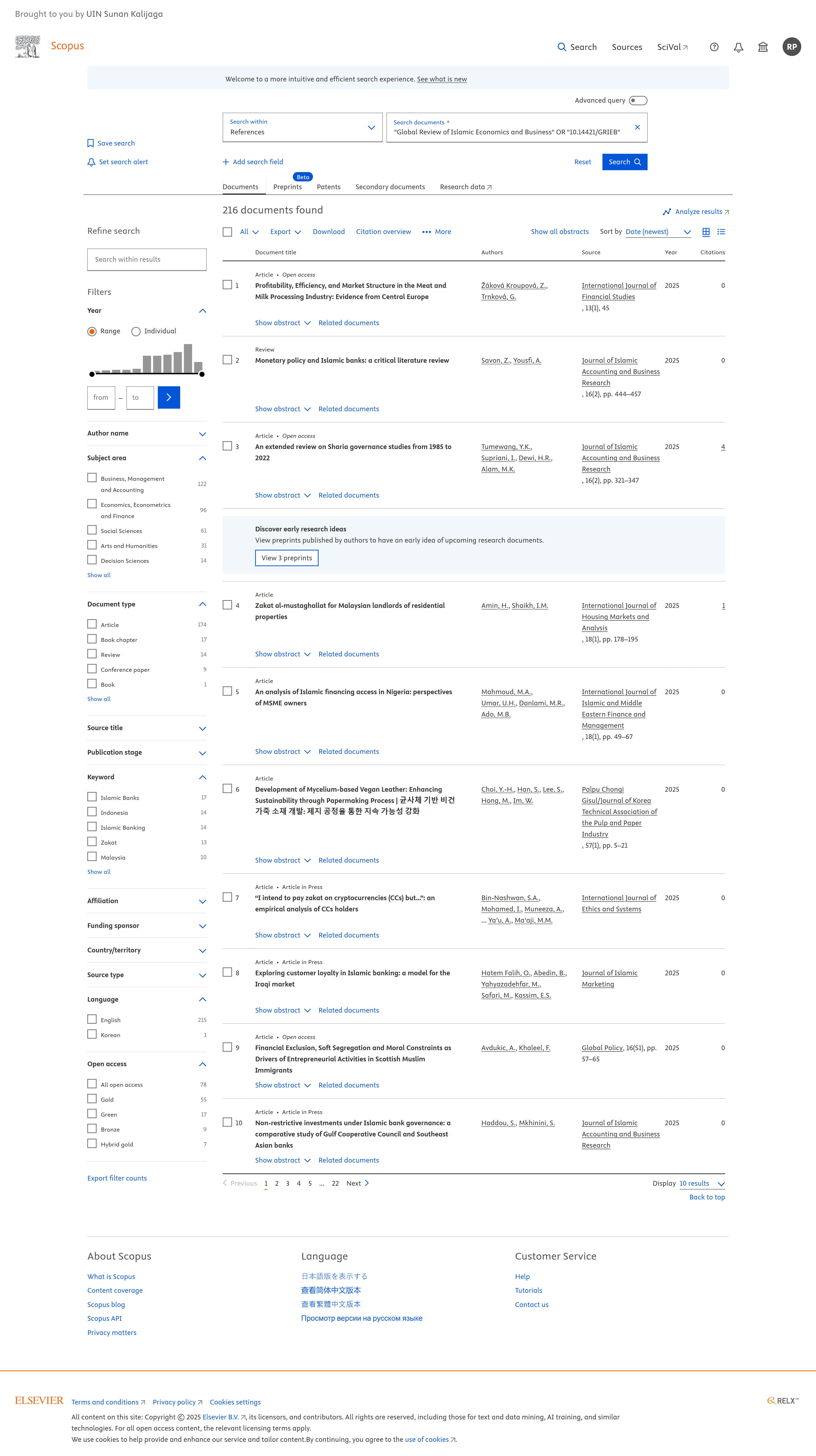

Global Review of Islamic Economics and Business (GRIEB) is cited by articles in the Scopus database at least 216 documents (see scopus.com) since it was published in 2013.

The citation details for each article in Scopus are as follows: Scopus

Quick Menu

Citation in Scopus

Contact Editor-in-Chief

Article Template

Tools

Visitors

Statistics

Published by: Faculty of Islamic Economics and Busines, State Islamic University (UIN) Sunan Kalijaga in cooperation with Consortium for Islamic Economics

Global Review of Islamic Economics and Business is currently being indexed by:

Editorial Office: Faculty of Islamic Economics and Business, State Islamic University (UIN) Sunan Kalijaga, Primary E-mail Contact: rosyid.putra@uin-suka.ac.id

All publication from Global Review of Islamic Economics and Business are licensed under a Creative Commons Attribution-ShareAlike

All publication from Global Review of Islamic Economics and Business are licensed under a Creative Commons Attribution-ShareAlike